Tip to Prepare When Thinking of Buying A Home

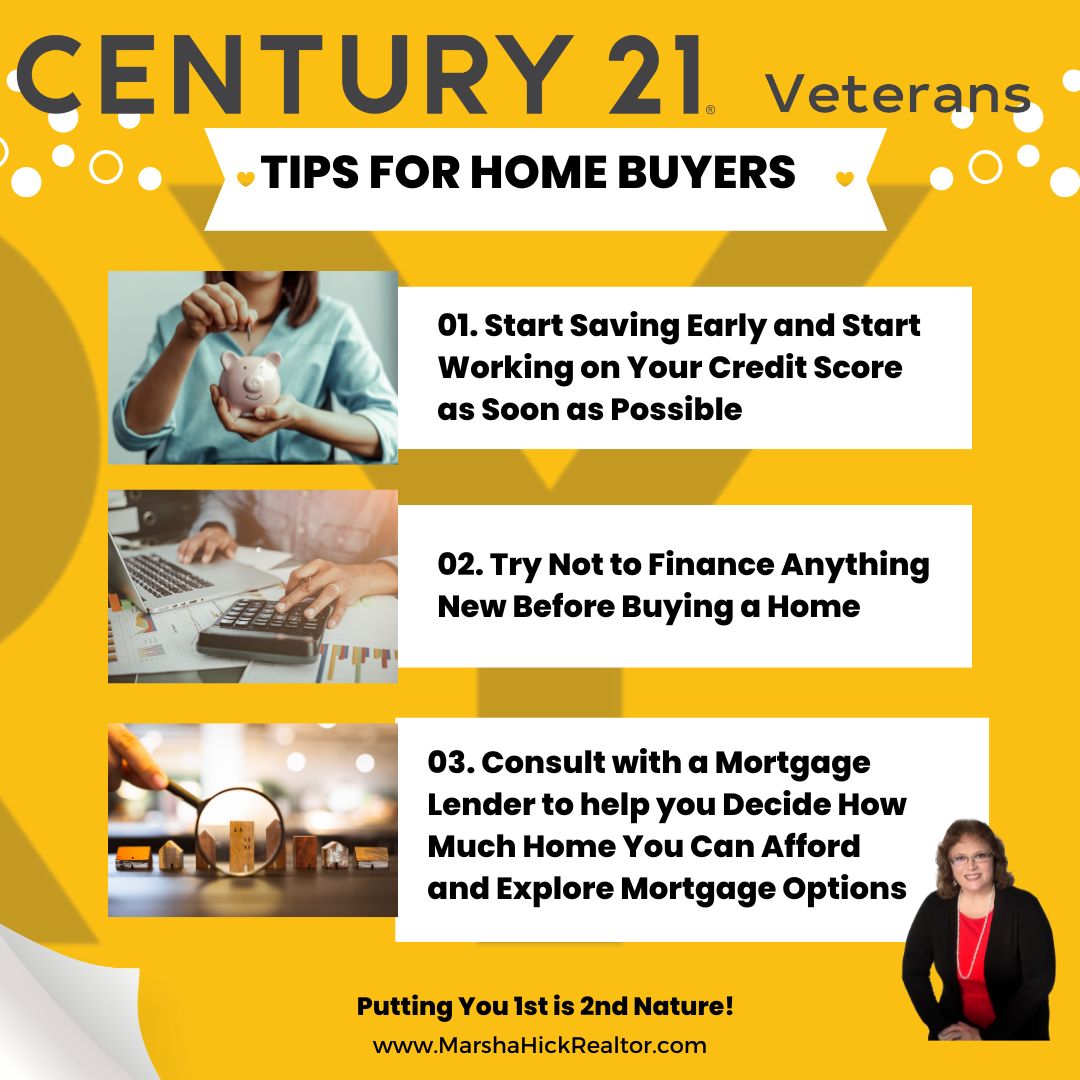

- Develop a budget and stick to it. Planning out your expenses and setting aside money for savings can help you stay within your means when purchasing a home. Shop around for a mortgage lender. Different lenders offer different rates and terms, so it’s important to compare and find the best fit for you. Pay your bills on time and maintain a low credit utilization rate. Paying bills on time and keeping your balances low will help you maintain a good credit score, which is essential for getting a good interest rate on a loan.

- One very important reason why home buyers should not purchase anything before a settlement is that it can be a huge financial risk. Until the settlement process is complete, the buyer cannot be sure that the house will actually be theirs. If for any reason the deal does not go through, the buyer may be stuck with a non-refundable purchase or a financial loss. It’s better to wait until the deal is finalized to make any major purchases or investments. Also, if the buyer does make a purchase, such as furniture, before the settlement, they may not be able to move it into the new home until after the settlement. This can be inconvenient and cost additional money for storage. Finally, until settlement, the buyer’s financial situation may change and their ability to purchase items may be affected. It’s best to wait until the settlement process is complete before making any major purchases.

- When speaking to a lender about how much home you can afford, it’s important to be honest and realistic. Be sure to provide accurate financial information about your current savings, income and existing debt. This will help the lender assess how much you can comfortably afford to pay for your new home. Additionally, don’t forget to ask about the different types of mortgages available, as well as any additional costs such as closing costs, taxes, and insurance. Being prepared and having an open dialogue with your lender can help ensure you find the perfect home for your budget.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link