How to Diversify Your Portfolio with Real Estate

How to Diversify Your Portfolio with Real Estate

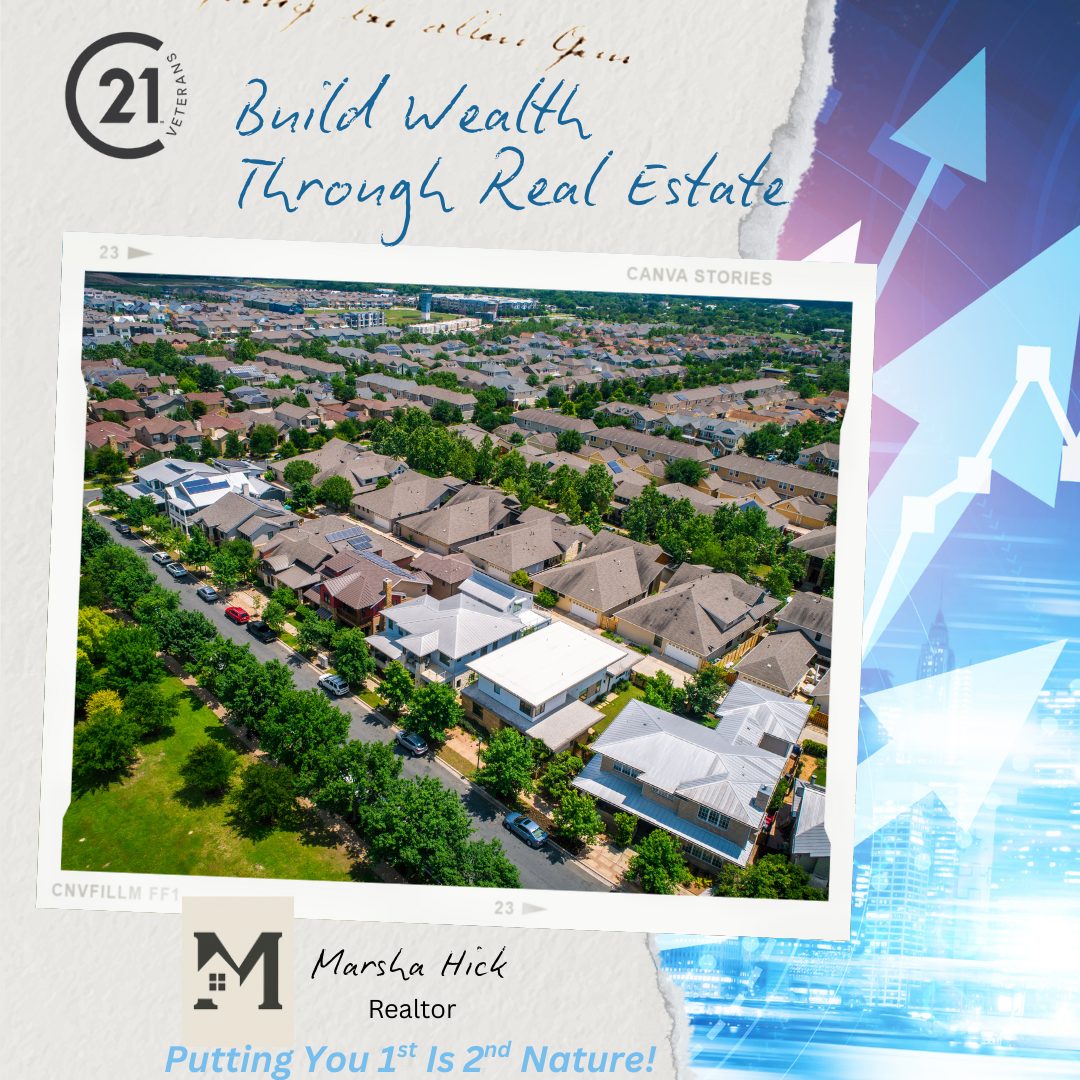

Real estate investing is a time-tested strategy for building wealth, but many investors overlook one of the most powerful ways to diversify: buying property in a college town. If you’re looking to expand your investment portfolio in 2025, this approach could provide both reliable income and long-term growth.

In Lower Bucks County and surrounding areas, opportunities near local colleges offer a unique edge. Here’s how—and why—you should consider renting by the room instead of by the house.

1. Why Diversification Matters in Real Estate

Investing in multiple property types and locations reduces your risk. When you diversify, you protect yourself from downturns in a single market or segment. Adding student housing to your portfolio can offer:

- Consistent demand: College students need housing every year, regardless of the economy.

- Higher rental income: Renting by the room often yields more per month than renting the entire home.

- Multiple revenue streams: Instead of relying on one tenant, you have income from several.

2. The Power of Renting by the Room

Traditional single-family rentals provide income from one source, but in a college town, you can rent out each bedroom to a different student. For example:

- A 4-bedroom home near campus rented for $2,000/month as a single unit might bring in $750/room when rented separately—that’s $3,000/month.

- Each tenant typically signs an individual lease, which means less risk if one tenant leaves.

This model also allows you to charge slightly more per room because utilities and furnishings are often included.

3. What to Look for in a College Town Property

To succeed with this strategy, choose properties that:

- Are within walking distance or a short drive to campus.

- Have multiple bedrooms and bathrooms.

- Offer communal spaces like a living room and kitchen.

- Allow for off-street parking or easy access to public transportation.

In Bucks County, look near schools like Bucks County Community College and nearby institutions in the greater Philadelphia area.

4. Set Yourself Up for Success

Before purchasing, make sure you:

- Check local zoning and rental regulations.

- Understand the seasonal nature of student housing.

- Budget for maintenance, turnover, and occasional vacancy.

Work with a real estate professional who understands both the investor market and the local area—someone who can help you choose a property that meets your goals.

5. The Long-Term Outcome: Reliable Cash Flow and Equity Growth

Student rentals often outperform traditional rentals when managed properly. By charging per room, you increase your monthly cash flow. Over time, the property’s value may rise, especially in markets with growing enrollment and expanding campuses.

This means you’re not only earning steady income—you’re also building long-term wealth.

Conclusion

If you’re looking to diversify your real estate portfolio in 2025, consider the strategic advantage of college town rentals. Renting by the room can boost your income, reduce your risk, and provide a steady stream of tenants year after year.

Want help finding the right investment property in Lower Bucks County or nearby? Contact me today to explore your options and start growing your portfolio with confidence.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link